A Disadvantage of the Corporate Form of Business Entity Is

Find out about the different types of business May 02 2022 3 min read. Generally the central office will provide services such as managerial expertise and capital for the divisions.

C corps are separately taxable entities.

. One of the first decisions youll make when starting a new business is choosing an entity type. The main difference between an LLC and a corporation is that an llc is owned by one or more individuals and a corporation is owned by its shareholders. If the LLC does not pay or file its return then the LLC members are not personally liable.

One disadvantage of the corporate tax structure is double taxation. Owners who organize their business as a sole proprietorship are personally responsible for the obligations of the business including actions of any employee representing the. Although the corporation is controlled by management located in the central office most operating decisions are left to autonomous divisions.

A sole proprietorship is one person operating a business without forming a corporation. Which is an advantage of the corporate form of business ownership. The legal form a firm chooses to operate under is an important decision with implications for how a firm structures its resources and assets.

The name is just a trade name instead of a legal entity. No corporate income taxes. Funds available to a business are limited to what one owner can gather which is disadvantage to the form of business known as an _.

Each involves a different approach to dealing with profits and losses Figure 910 Business Forms. The LLC will report all income and deductions on Form 1120 annually and pay the appropriate amount. In most cases it is a fictitious name that someone does business under such as Tims Plumbing Service.

A corporate structure is perhaps the most advantageous way to start a business because the corporation exists as a separate entity. Start studying Chapter 5 How to form a business. Easiest simplest and least costly business entity to form and operate.

Financial activities of the business eg receipt of fees are maintained separately from the persons personal financial activities eg house payment. Generally most entrepreneurs choose to form a Corporation or a Limited Liability Company LLC. For small business owners evaluating S corporations vs.

Your business name is your first touchpoint with customers so make sure it connects with your brand and purpose. Several legal forms of business are available to executives. Business is the activity of making ones living or making money by producing or buying and selling products such as goods and services.

The income of the business is then taxed in the hands of the owner the proprietor at personal income tax rates. Income from the business is taxed at the corporate level. They file a corporate tax return Form 1120 and pay taxes at the corporate level.

Although a sole proprietorship is not a separate legal entity from its owner it is a separate entity for accounting purposes. Depending on the level and specialization of the employee they often know your business and industry intricately. Advantages of a sole proprietorship include.

When you form a new business youll probably have to register with state or local authorities. Need quotation to verify It is also any activity or enterprise entered into for profitHaving a business name does not separate the business entity from the owner which means that the owner of the business is responsible and liable for debts. Employees are the most valuable part of your company.

Choosing a Form of Business. C corporations the decision usually comes down to how they want the corporation to be treated for federal income tax purposes. In general a corporation has all the legal rights of an.

When a business is started it can be structured as a proprietorship partnership or corporation. Multi-divisional forms that are all part of a single legal entity Chandler 1962 1977 1990. Jul 02 2021 2 min read How to Form an Arizona Corporation.

This knowledge helps them to make your company successful. It is not a legal entity separate from the business owner. Learn vocabulary terms and more with flashcards games and other study tools.

But given to a competing entity it could prove to be a distinct disadvantage to your organization. Any income realized by a sole proprietorship is declared on the owners individual income tax return.

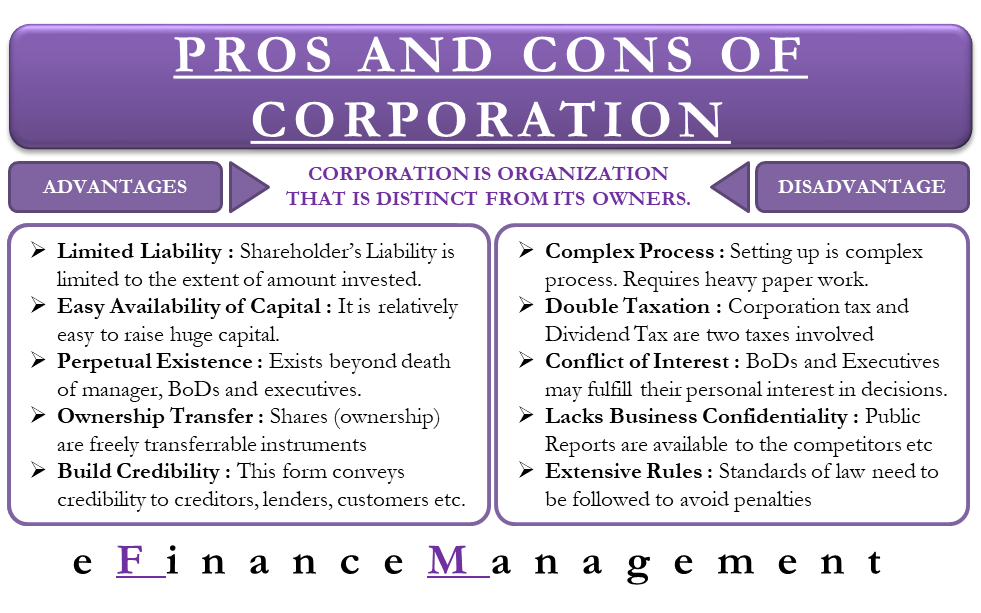

Advantages And Disadvantages Of Corporations

Cooperative Advantages And Disadvantages

C Corporation Defintiion Formation Steps Advantages Disadvantages Bookkeeping Business C Corporation Money Management Advice

No comments for "A Disadvantage of the Corporate Form of Business Entity Is"

Post a Comment